Solar Fund

A flexible, smart funding solution for commercial

solar PV installations

- Achieve net positive cashflow outcomes from day one

- No capital, deposit or additional personal security required

- Low, fixed rate interest periods with predicable repayments

How It Works:

Solar Fund Finance

Our Solar Fund offers long loan tenors with competitive fixed rate interest periods for solar PV upgrades to existing commercial buildings. With terms of up to 20 years available, your project could be cashflow positive from day one – with your savings exceeding repayments.

Our expert team can work with you and your solar installer to find the perfect term that maximises your savings and cashflow.

Don’t be scared of the longer finance term – Solar Fund’s unique structure mean that the finance is secured by the land, not the owner, so that if the property is sold, the solar system and the finance stay with the property for the new owner to benefit from.

A form of Environmental Upgrade Finance, our Solar Fund does what other financial products simply can’t, and helps businesses realise their dream of saving money and generating their own electricity.

Benefits |

Solar Fund | Other Finance |

| Up to 100% project finance, including hard and soft costs | X | |

| Terms of up to 20 years | X | |

| Competitive interest rates with predicable quarterly repayments | X | |

| Loan fully transferrable upon sale of building | X | |

| No additional personal security required | X | |

| Repayments can be shared with tenants without renegotiating lease | X |

Financing your solar project with Solar Fund is surprisingly easy.

- Engage a solar installer to scope and quote on the works. To work with an SAF endorsed partner, have a look here

- Our expert team will work with you to match a Solar Fund term that maximises your business cashflow

- Project is greenlit, and your business, local council and SAF sign an Environmental Upgrade Agreement (EUA)

- Up to three progress payments can be made and down payment refunded to customer

- A fixed Environmental Upgrade Charge (EUC) will be sent with your next local council rates notice

What Can be Funded?

Any type of business can apply for Solar Fund, provided:

- Council supports environmental upgrade finance

- Building is on rateable land

- Primarily a non-residential property

- Upgrade has a measurable environmental benefit

This includes Agriculture, Commercial Office Building, Tourism and Commercial and Industrial properties.

So long as the works have a measurable environmental benefit, they will likely qualify.

![]()

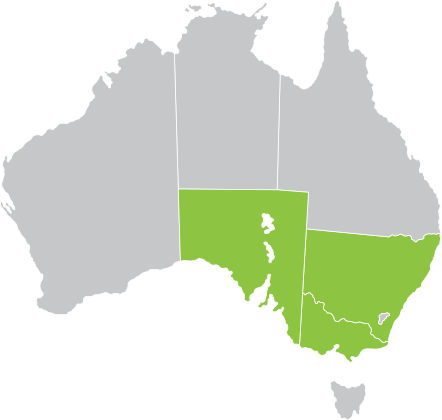

Check Availability in Your Area

Our finance is currently enabled in Victoria, New South Wales and South Australia. Look up your address

to see if it's available to businesses in your council area.

Look Up Your Address Please enter your business street address, or council, so we can check if our finance is available there.

Now Available

New Fast Track Green Loan now available!

Our new Fast Track Green loan will deliver more speed, greater flexibility, and extra choices for our customers.

This includes:

+ Accelerated approval: With our Fast Track Green Loan, eligible businesses can secure up to $200,000 without the need to submit financials for faster approvals.

+ Fixed and Variable Rate Interest Options: All our eligible businesses can now choose an SAF green loan, including out Fast Track Green Loan with either a fixed or variable interest rate, providing the flexibility in funding you deserve.

Find out more and apply today!

Our new Fast Track Green loan will deliver more speed, greater flexibility, and extra choices for our customers.

This includes:

+ Accelerated approval: With our Fast Track Green Loan, eligible businesses can secure up to $200,000 without the need to submit financials for faster approvals.

+ Fixed and Variable Rate Interest Options: All our eligible businesses can now choose an SAF green loan, including out Fast Track Green Loan with either a fixed or variable interest rate, providing the flexibility in funding you deserve.

Find out more and apply today!