Capital Fund

Capital Fund is a new source of cost-effective

construction finance, repaid through council rates

- Replace expensive mezzanine debt or equity

- Decrease financial risk

- Improve environmental performance

How It Works:

Capital Fund Finance

Capital Fund is a new and innovative way to finance environmental improvements to a building. It diversifies the capital stack – giving owners the ability to minimise risk and replace more expensive debt or equity. With Capital Fund, loan terms of up to 20 years are available.

Capital Fund is a form of Environmental Upgrade Finance, and can be used to bridge the gap between traditional bank debt and equity investment. Because repayments are made through council rates, it comes with very competitive rates and terms, reducing the overall cost of capital, increasing developer returns and means your building will be a better environmental performer than the competition.

With long dated loan terms, Capital Fund’s unique structure mean that the finance is secured by the land, not the owner, so that if the property is sold, the finance can stay with the property (along with all the project benefits) for the new owner to benefit from.

An example of how Capital Fund can work in construction finance:

Equity

20% p.a.

Construction Debt

6% p.a.

Traditional

WACC 11.6%*

Equity

20% p.a.

Capital Fund 6.5% p.a.*

Construction Debt

6% p.a.

Capital Fund

WACC 10.3%**

*indicative interest rate. **net of upfront fees and charges

Capital Fund’s unique terms make it ideal for inclusion in major, transformational construction projects, such as building repositions, major refurbishments, retrofits and other significant projects that have an environmental upgrade component.

Benefits of Capital Fund

- Diversify your sources of capital

- Available for 100% environmental upgrade project costs – including hard, soft and auxiliary costs – of up to $20m

- Interest capitalisation available for up to two years

- Terms of up to 20 years

- Competitive fixed period interest rates with predictable repayments

- Repayments can be shared between landlords and tenants

- Can be transferred to new owner if property sold before facility repaid

- Often more affordable capital then most other equity and mezzanine debt within the capital stack

- Can be tailored to fit a bespoke financial structure

What Can be Funded?

Capital Fund can be used for projects including office, retail, healthcare, industrial, manufacturing, hotels, cold stores, specialised manufacturing, sporting and more.

Eligible works can include anything that has an environmental benefit such as energy efficiency, solar, base building(insulation, windows etc) water efficiency, water harvesting and waste minimisation

- Council supports environmental upgrade finance

- Building is on rateable land

- Primarily a non-residential property

- Upgrade has a measurable environmental benefit

![]()

Check Availability in Your Area

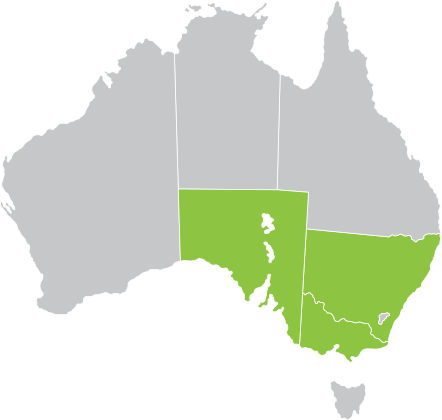

Our finance is currently enabled in Victoria, New South Wales and South Australia. Look up your address

to see if it's available to businesses in your council area.

Look Up Your Address Please enter your business street address, or council, so we can check if our finance is available there.

Now Available

New Fast Track Green Loan now available!

Our new Fast Track Green loan will deliver more speed, greater flexibility, and extra choices for our customers.

This includes:

+ Accelerated approval: With our Fast Track Green Loan, eligible businesses can secure up to $200,000 without the need to submit financials for faster approvals.

+ Fixed and Variable Rate Interest Options: All our eligible businesses can now choose an SAF green loan, including out Fast Track Green Loan with either a fixed or variable interest rate, providing the flexibility in funding you deserve.

Find out more and apply today!

Our new Fast Track Green loan will deliver more speed, greater flexibility, and extra choices for our customers.

This includes:

+ Accelerated approval: With our Fast Track Green Loan, eligible businesses can secure up to $200,000 without the need to submit financials for faster approvals.

+ Fixed and Variable Rate Interest Options: All our eligible businesses can now choose an SAF green loan, including out Fast Track Green Loan with either a fixed or variable interest rate, providing the flexibility in funding you deserve.

Find out more and apply today!